Jan 01, 1970

Recent Posts

Introduction to Futures and Options (F&O)

Jan 01, 1970

What is the RSI Indicator? A Beginner’s Guide

Jan 01, 1970

Intraday Option Trading in MCX

Jan 01, 1970

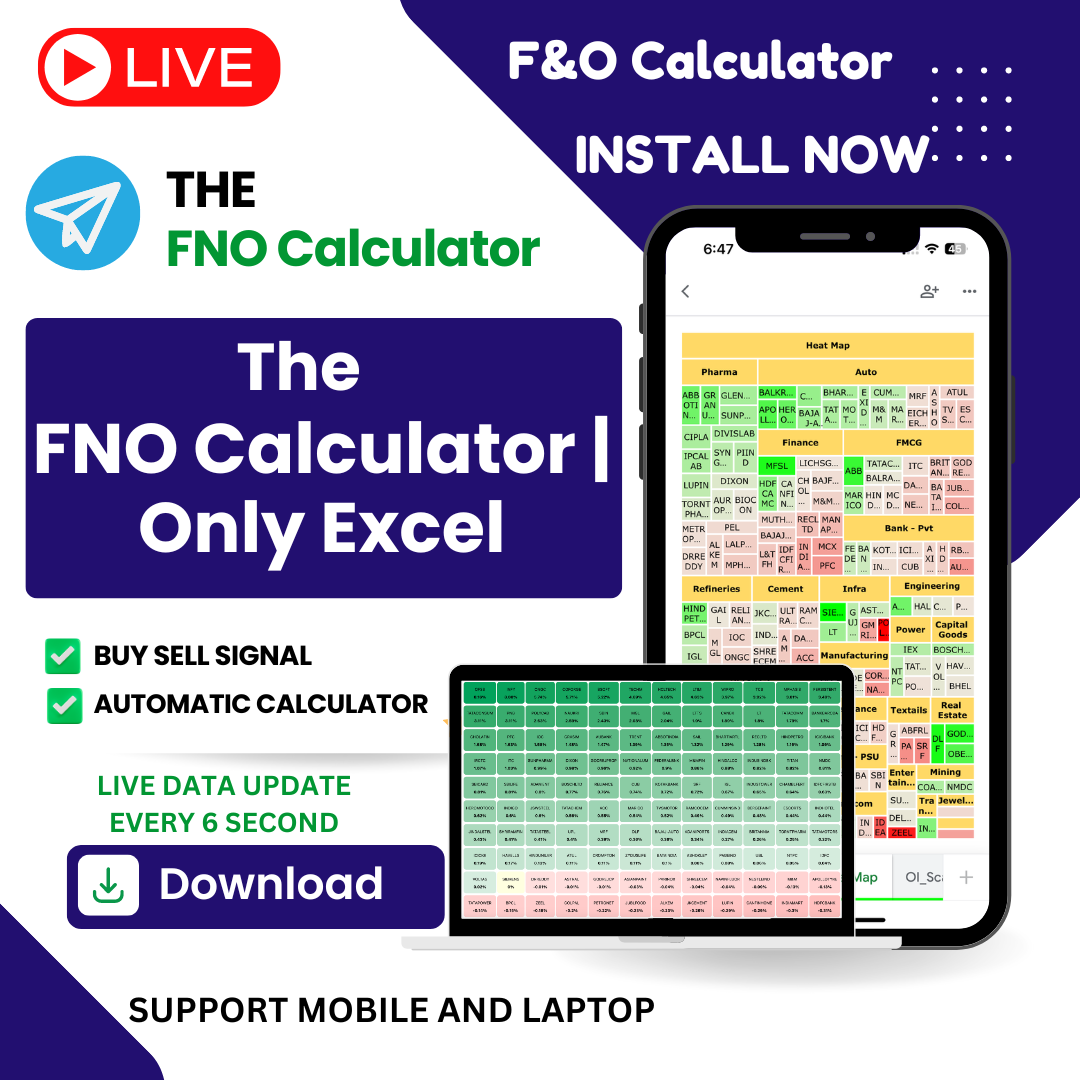

FNO Calculator

Jan 01, 1970

What is a multibagger stock?

Jan 01, 1970

6 best formulas to choose mutual funds

Jan 01, 1970

Highest Dividend Yield Shares

Jan 01, 1970