- Home

- Blog

- Aurobindo Pharma

Aurobindo Pharma

Last updated on Nov 03, 2022 in Stock Market

Detail about Aurobindo Pharma

Aurobindo Pharma commenced operations in 1988- 89 with a single unit manufacturing semi-Synthetic Penicillin( SSP) at Pondicherry. The company came to a public company in 1992 and listed its shares on the Indian stock exchanges in 1995. In addition to being the request leader semi-Synthetic Penicillin, it has a presence in crucial remedial parts similar as neurosciences( CNS), cardiovascular( CVS),anti-retroviral,anti-diabetics, gastroenterology, and anti-biotics. Through cost-effective manufacturing capabilities and many pious guests, the company also entered the high periphery specialty general phrasings member. moment, it has evolved into a knowledge-driven company manufacturing active pharmaceutical constituents and expression products. It's R&D concentrated and has a multi-product portfolio with manufacturing installations in several countries. The expression business is totally organized with a divisional structure and has a focused platoon for crucial transnational requests. The company’s units for APIs interceders and units for phrasings are designed to meet the conditions of both advanced as well as arising request openings.

A well-integrated pharma company, the company features among the top 2 Pharmaceutical companies in India in terms of consolidated earnings. Aurobindo exports to numerous countries across the globe with around 90 of its earnings deduced from transnational operations. Its guests include ultra-expensive multinational companies. With multiple installations approved by leading nonsupervisory agencies similar as USFDA, EU GMP, UK MHRA, South Africa- MCC, Health Canada, WHO, and Brazil ANVISA, Aurobindo makes use of in-house R&D for a rapid-fire form of patents, Drug Master Files( DMFs), shortened New Drug Applications( ANDAs) and expression dossiers across the world. It's among the largest filers of DMFs and ANDAs in India.

Brands

These are the brands of Aurobindo Pharma.

|

Molnaflu

|

Imdur

|

Betaloc

|

Seloken

|

Ramace

|

|

Plendil

|

RHINOCORT

|

Prostodin

|

MERONEM

|

XyloCaine

|

|

SensorCaine

|

Iressa

|

Casodex

|

CRESTOR

|

|

Business area of the company

Aurobindo Pharma continues to be one of the world’s fastest-growing Active Pharmaceutical constituents( API) manufacturing companies, driven by cost leadership, inflexibility to produce multiple products in the same manufacturing installations and capabilities in colorful remedial disciplines. Its API business has assured the profitability and growth of its phrasings business through flawless perpendicular integration. Its API business is supported by a technologically advanced exploration and development structure, which develops new products and plays a part in the delivery of products to the request. It has erected a strong presence in crucial remedial parts similar to the Central nervous system( CNS), cardiovascular( CVS),anti-retroviral( ARV),anti-diabetics, gastroenterology, and antibiotics. Also, it's erecting a diversified channel in high-periphery specialty general phrasings members.

Awards & Accolades

2019- 20

- Bagged the coveted 14th National BML Munjal Award for ’ Business Excellence through Learning & Development ’ in the Private Sector Manufacturing order from Bharat Ratna Pranab Mukherjee, Former President of India.

- Aurobindo Unit- III has bagged the Special Commendation Award in the Golden Peacock Environmental Management Awards 2019 from the Institute of Directors( IOD). These awards are regarded as a standard of commercial excellence worldwide.

- Aurobindo has been awarded as Stylish Energy Effective Organization under Large Scale Industry Category in CII’s 4th edition of National Energy Efficiency Circle Competition.

Peers

|

S.NO.

|

COMPANY

|

MCAP Cr.

|

P/B

|

P/E

|

EPSRs.

|

ROE%

|

EV/EBITDA

|

|

1

|

Sun Pharma Inds.

|

2,20,222.96

|

8.6

|

209.72

|

4.38

|

-0.39

|

45.57

|

|

2

|

Divi''s Lab

|

98,312.31

|

7.94

|

31.84

|

116.33

|

28.13

|

23.74

|

|

3

|

Cipla

|

88,540.18

|

3.83

|

33.62

|

32.63

|

12.7

|

21.85

|

|

4

|

Dr. Reddy''s Lab

|

71,076.02

|

3.8

|

41.58

|

102.68

|

9.26

|

21.47

|

|

5

|

Torrent Pharma

|

50,573.90

|

7.48

|

48.44

|

30.85

|

16.02

|

22.68

|

|

6

|

Alkem Laboratories

|

39,421.78

|

4.44

|

32.52

|

101.37

|

18.83

|

23.72

|

|

7

|

Abbott India

|

38,546.66

|

12.93

|

47.67

|

380.52

|

29.95

|

30.41

|

|

8

|

Zydus Lifesciences

|

37,365.52

|

2.91

|

47.33

|

7.8

|

6.6

|

19.43

|

|

9

|

Biocon

|

34,103.04

|

4.26

|

474.29

|

0.6

|

1.09

|

147.37

|

|

10

|

Gland Pharma

|

33,778.42

|

4.58

|

30.96

|

66.24

|

18.62

|

19.57

|

|

11

|

Lupin

|

30,472.29

|

1.68

|

0

|

-15.78

|

-1.04

|

-115.64

|

|

12

|

Aurobindo Pharma

|

29,329.16

|

1.7

|

21.54

|

23.24

|

8.81

|

15.77

|

|

13

|

Laurus Labs

|

26,972.75

|

7.47

|

35.51

|

14.14

|

24.65

|

21.11

|

|

14

|

Glaxosmithkline Phar

|

23,690.59

|

8.48

|

59.23

|

23.61

|

18.04

|

24.27

|

|

15

|

Ipca Laboratories

|

22,721.75

|

4.01

|

31.12

|

28.78

|

16.95

|

19.49

|

|

16

|

Piramal Enterprises

|

20,362.79

|

0.88

|

37.21

|

22.93

|

2.47

|

18.17

|

|

17

|

Pfizer

|

19,042.72

|

6.57

|

42.77

|

97.32

|

23.3

|

21.48

|

|

18

|

Ajanta Pharma

|

15,975.28

|

4.8

|

23.61

|

52.82

|

23.78

|

16.01

|

|

19

|

JB Chem & Pharma

|

14,622.97

|

6.83

|

42.14

|

44.87

|

18.77

|

26.75

|

|

20

|

Sanofi India

|

13,445.85

|

9.24

|

13.73

|

425.09

|

44.65

|

15.77

|

|

21

|

Alembic Pharma

|

11,838.01

|

2.21

|

17.57

|

34.28

|

10.46

|

13.06

|

|

22

|

Natco Pharma

|

10,954.34

|

2.44

|

29.46

|

20.37

|

3.37

|

18.91

|

|

23

|

Suven Pharma

|

10,850.83

|

6.64

|

18.37

|

23.2

|

43.17

|

13.33

|

|

24

|

Glenmark Pharma

|

10,799.99

|

0.63

|

5.4

|

70.91

|

12.67

|

6.05

|

|

25

|

Eris Lifesciences

|

9,500.31

|

4.72

|

23.4

|

29.86

|

23.92

|

18.3

|

|

26

|

Granules India

|

7,900.68

|

2.99

|

18.75

|

16.97

|

16.55

|

12.07

|

|

27

|

Astrazeneca Pharma I

|

7,670.63

|

14.48

|

107.27

|

28.6

|

12.78

|

62.61

|

|

28

|

Procter&Gamble Healt

|

6,582.98

|

10.68

|

34.19

|

115.98

|

22.04

|

21.74

|

|

29

|

Caplin Point Lab

|

5,487.20

|

5.57

|

27.92

|

25.93

|

22.56

|

18.47

|

|

30

|

Jubilant Pharmova

|

5,179.03

|

4.06

|

69.56

|

4.67

|

6.12

|

48.32

|

|

31

|

Glenmark Life Scienc

|

4,693.40

|

2.17

|

11

|

34.81

|

29.87

|

6.69

|

|

32

|

FDC

|

4,313.66

|

2.13

|

22.4

|

11.61

|

11.97

|

14.94

|

|

33

|

Aarti Drugs

|

4,154.50

|

4.16

|

23.63

|

18.99

|

21.29

|

15.46

|

|

34

|

Hikal

|

4,029.47

|

3.8

|

39.87

|

8.2

|

16.04

|

17.17

|

|

35

|

Wockhardt

|

3,432.23

|

1.59

|

0

|

-8.87

|

-7.42

|

16.44

|

|

36

|

AMI Organics

|

3,237.25

|

6.08

|

44.29

|

20.06

|

21.1

|

28.88

|

|

37

|

Shilpa Medicare

|

3,107.07

|

1.5

|

38.22

|

9.37

|

1.09

|

19.62

|

|

38

|

Advanced Enzyme

|

3,053.74

|

6.26

|

69.82

|

3.91

|

11.95

|

45.43

|

|

39

|

Strides Pharma Scien

|

2,892.90

|

0.87

|

21.4

|

14.97

|

5.42

|

31.74

|

|

40

|

Indoco Remedies

|

2,871.87

|

3.05

|

18.72

|

16.64

|

18.47

|

10.05

|

|

41

|

Unichem Lab

|

2,645.50

|

1

|

0

|

-7.23

|

-2.07

|

170.28

|

|

42

|

Sequent Scientific

|

2,503.07

|

2.49

|

154.05

|

0.65

|

1.47

|

86.12

|

|

43

|

Supriya Lifescience

|

2,385.11

|

3.72

|

15.71

|

18.86

|

34.34

|

9.85

|

|

44

|

Amrutanjan Healthcar

|

2,110.01

|

7.87

|

35.89

|

20.11

|

28.03

|

24.09

|

|

45

|

Gufic Biosciences

|

2,095.46

|

7.22

|

24.45

|

8.84

|

43.31

|

15.63

|

|

46

|

IOL Chem & Pharma

|

2,013.60

|

1.41

|

15.08

|

22.75

|

12.5

|

8.22

|

|

47

|

Marksans Pharma

|

1,880.79

|

2.65

|

19.95

|

2.33

|

16.11

|

11.2

|

|

48

|

Hester Biosciences

|

1,719.79

|

6.29

|

53.27

|

37.95

|

15.62

|

32.69

|

|

49

|

Neuland Laboratories

|

1,659.29

|

1.96

|

25.64

|

50.45

|

7.86

|

12.64

|

|

50

|

Alembic

|

1,579.21

|

1.55

|

18.45

|

3.33

|

9.31

|

15.62

|

|

51

|

Solara Active Pharma

|

1,493.13

|

0.99

|

0

|

-35.64

|

-3.76

|

142.05

|

|

52

|

Dishman Carbogen Amc

|

1,467.49

|

0.35

|

0

|

-2.71

|

-0.68

|

22.38

|

|

53

|

TTK Healthcare

|

1,285.65

|

3.9

|

38.34

|

23.73

|

6.02

|

16.13

|

|

54

|

Orchid Pharma

|

1,272.25

|

1.92

|

0

|

-10.64

|

-7.76

|

21.07

|

|

55

|

Morepen Laboratories

|

1,267.70

|

1.75

|

16.44

|

1.51

|

20.77

|

12.18

|

|

56

|

Medicamen Biotech

|

1,251.32

|

7.16

|

87.27

|

11.33

|

11.12

|

49.77

|

|

57

|

RPG Life Sciences

|

1,216.36

|

4.44

|

21.68

|

33.93

|

21.8

|

12.06

|

|

58

|

Suven Life Sciences

|

1,019.86

|

2.15

|

0

|

-2.07

|

-8.62

|

-33.52

|

|

59

|

Bajaj Healthcare

|

971.05

|

2.85

|

15.13

|

23.26

|

24.33

|

10.87

|

|

60

|

Themis Medicare

|

926.33

|

3.63

|

19.94

|

50.5

|

28.72

|

12.03

|

|

61

|

Jagsonpal Pharma

|

923.09

|

7.48

|

70.42

|

5

|

16.52

|

34.78

|

|

62

|

NGL Fine-Chem

|

908.76

|

4.39

|

27.2

|

54.08

|

28.86

|

17.73

|

|

63

|

Guj. Themis Biosyn

|

880.73

|

7.27

|

18.17

|

33.36

|

50.35

|

12.72

|

|

64

|

Panacea Biotec

|

801.77

|

2.35

|

0

|

-23.57

|

-2.11

|

-7.65

|

|

65

|

Bliss GVS Pharma

|

791.08

|

0.91

|

8.27

|

9.21

|

11.68

|

4.98

|

|

66

|

Kopran

|

780.05

|

2.04

|

53.15

|

3.04

|

3.75

|

30.03

|

|

67

|

Zota Health Care

|

757.58

|

8.16

|

87.38

|

3.45

|

-0.24

|

52.73

|

|

68

|

Beta Drugs

|

757.57

|

9.78

|

53.18

|

14.82

|

11.64

|

28.6

|

|

69

|

Syncom Formulations

|

754.82

|

3.07

|

41.35

|

0.19

|

18.04

|

25.6

|

|

70

|

SMS Pharmaceuticals

|

732.24

|

1.51

|

20.9

|

4.14

|

15.32

|

12.72

|

|

71

|

Fermenta Biotech

|

610.1

|

1.59

|

32.97

|

6.29

|

8.18

|

12.18

|

|

72

|

Lincoln Pharma

|

553.22

|

1.24

|

8.32

|

33.21

|

18.05

|

5.38

|

|

73

|

Natural Capsules

|

523.64

|

5.78

|

30.62

|

18.29

|

11.8

|

16.9

|

|

74

|

Windlas Biotech

|

504.98

|

1.25

|

12.12

|

19.12

|

13.02

|

6.3

|

|

75

|

Nectar Lifesciences

|

467.58

|

0.43

|

17.2

|

1.21

|

2.36

|

7.65

|

|

76

|

Fredun Pharma

|

461.69

|

6.56

|

66.43

|

15.61

|

4.77

|

28.47

|

|

77

|

Anuh Pharma

|

457.52

|

2.07

|

14.16

|

6.45

|

15.11

|

8.23

|

|

78

|

Kwality Pharma

|

437.56

|

2.28

|

3.64

|

115.69

|

28.55

|

2.74

|

|

79

|

Panchsheel Organics

|

382.72

|

7.27

|

37.72

|

8.59

|

13.35

|

24.66

|

|

80

|

Sakar Healthcare

|

377.76

|

2.45

|

26.12

|

7.77

|

13.49

|

14.29

|

|

81

|

Zim Laboratories

|

376.16

|

2.14

|

20.37

|

11.37

|

3.64

|

9.24

|

|

82

|

Zenotech Laboratorie

|

360.69

|

4.85

|

16.07

|

3.68

|

-2.48

|

19.36

|

|

83

|

Lyka Labs

|

357.19

|

7.98

|

17.35

|

7.17

|

163.37

|

6.19

|

|

84

|

Ind-Swift Lab.

|

329.41

|

0.72

|

0

|

-0.73

|

-1.04

|

5.23

|

|

85

|

Samrat Pharmachem

|

318.89

|

5.68

|

12.46

|

82.85

|

19.77

|

9.04

|

|

86

|

Albert David

|

314.38

|

1.12

|

11.83

|

46.56

|

13.46

|

6.28

|

|

87

|

Shree Ganesh Remed.

|

284.56

|

4.42

|

20.44

|

11.6

|

21.18

|

12.63

|

|

88

|

Venus Remedies

|

269.14

|

0.58

|

5.92

|

34.03

|

11.72

|

3.42

|

|

89

|

Brooks Laboratories

|

265.93

|

4.46

|

0

|

-2.16

|

-19.17

|

-89.19

|

|

90

|

Jenburkt Pharma

|

258.08

|

2.09

|

10.94

|

51.42

|

20.66

|

6.32

|

|

91

|

Kilitch Drugs(India)

|

256.17

|

1.41

|

24.04

|

6.84

|

3.93

|

16.75

|

|

92

|

Smruthi Organics

|

253.82

|

3.76

|

31.14

|

7.12

|

16.27

|

15.95

|

|

93

|

Krebs Biochem.&Inds

|

236.09

|

0

|

0

|

-20.06

|

0

|

-10.47

|

|

94

|

Bafna Pharma

|

234.43

|

3.65

|

52.97

|

1.87

|

8.61

|

19.56

|

|

95

|

Mangalam Drugs&Org.

|

227.29

|

1.48

|

12.46

|

11.53

|

23.82

|

6.02

|

|

96

|

Ambalal Sarabhai Ent

|

220.7

|

6.38

|

0

|

-1.3

|

-26.43

|

36.48

|

|

97

|

Medico Remedies

|

208.37

|

5.53

|

42.61

|

2.95

|

14.02

|

23.49

|

|

98

|

Wanbury

|

206.15

|

0

|

2.75

|

22.97

|

0

|

11.36

|

|

99

|

ANG Lifesciences

|

203.51

|

2.28

|

5.12

|

30.65

|

18.46

|

3.72

|

|

100

|

SMS Lifesciences

|

195.82

|

1.26

|

7.36

|

87.95

|

10.99

|

6.55

|

|

101

|

Kimia Biosciences

|

192.56

|

12.04

|

0

|

-0.62

|

32.19

|

82.44

|

|

102

|

Bharat Parenterals

|

186.32

|

1.11

|

12.6

|

25.61

|

15.16

|

7.24

|

|

103

|

Lasa Supergenerics

|

153.13

|

1.12

|

0

|

-4.49

|

15.17

|

58.1

|

|

104

|

Syschem (India)

|

147.97

|

8.69

|

301.31

|

0.16

|

-66.17

|

51.68

|

|

105

|

Bal Pharma

|

142.41

|

1.57

|

16.84

|

5.43

|

10.47

|

8.42

|

|

106

|

Tyche Inds

|

137.2

|

1.28

|

11.91

|

11.24

|

23.08

|

4.67

|

|

107

|

Alpa Lab

|

123.51

|

0.92

|

12.16

|

4.83

|

6.38

|

6.62

|

|

108

|

Gennex Lab

|

116.89

|

1.53

|

31.42

|

0.21

|

10.66

|

18.81

|

|

109

|

Bharat Immunological

|

114.43

|

1.14

|

0

|

-2.03

|

-66.45

|

-33.94

|

|

110

|

Denis Chem Lab

|

111.71

|

1.63

|

16.44

|

4.9

|

9.79

|

6.86

|

|

111

|

Source Natural Foods

|

111.1

|

6.92

|

51.63

|

3.34

|

29.4

|

32.19

|

|

112

|

Everest Organics

|

104.12

|

2.36

|

0

|

-4.68

|

33.96

|

41.36

|

|

113

|

Vaishali Pharma

|

102.09

|

3.66

|

21.61

|

4.48

|

4.78

|

12.6

|

|

114

|

Coral Laboratories

|

89.32

|

0.57

|

18.5

|

13.51

|

10.74

|

7.56

|

|

115

|

Parnax Lab

|

87.64

|

4.29

|

131.57

|

0.58

|

-21.49

|

58.52

|

|

116

|

Lactose India

|

85.61

|

2.17

|

26.81

|

2.54

|

6.65

|

9.06

|

|

117

|

Makers Laboratories

|

84.76

|

1.73

|

0

|

-4.06

|

0.34

|

81.52

|

|

118

|

Vivimed Labs

|

83.74

|

0.21

|

0

|

-10.56

|

-3.65

|

-13.4

|

|

119

|

BDH Inds

|

83.34

|

1.71

|

10.99

|

13.17

|

16.27

|

6.46

|

|

120

|

Chandra Bhagat Pharm

|

80.17

|

3.01

|

100.46

|

1.06

|

0.78

|

24.39

|

|

121

|

Biofil Chem & Pharma

|

77.3

|

4.54

|

105.74

|

0.45

|

8.01

|

51.3

|

|

122

|

Kerala Ayurveda

|

74

|

6.66

|

78.39

|

0.89

|

-53.02

|

18.45

|

|

123

|

Mercury Laboratories

|

68.89

|

1.65

|

17.65

|

32.53

|

15.5

|

8.54

|

|

124

|

Sandu Pharmaceutical

|

59.82

|

2.17

|

44.55

|

1.52

|

5.03

|

18.11

|

|

125

|

Vineet Laboratories

|

54.9

|

1.6

|

8.61

|

6.91

|

13.18

|

4.45

|

|

126

|

Sanjivani Paranteral

|

53.49

|

0

|

8.89

|

6.02

|

0

|

13.41

|

|

127

|

Deccan Health Care

|

52.83

|

0.65

|

163.07

|

0.19

|

0.51

|

9.1

|

|

128

|

Roopa Industries

|

51.52

|

4.02

|

49.21

|

1.33

|

6.41

|

17.16

|

|

129

|

Ind-Swift

|

51.19

|

0

|

0

|

-5.89

|

0

|

18.82

|

|

130

|

Godavari Drugs

|

49.48

|

1.62

|

10.44

|

6.3

|

19.42

|

6.58

|

|

131

|

Auro Laboratories

|

49.11

|

1.55

|

26.39

|

2.99

|

9.47

|

11.43

|

|

132

|

Cian Healthcare

|

44.99

|

0.72

|

0

|

-0.91

|

0.62

|

17.05

|

|

133

|

Adeshwar Meditex

|

36.8

|

1.21

|

46.41

|

0.55

|

8.5

|

16.17

|

|

134

|

Decipher Labs

|

35.35

|

3.06

|

101.3

|

0.35

|

0.87

|

88.89

|

|

135

|

Shukra Pharma

|

30.53

|

1.83

|

29.3

|

6.66

|

1.21

|

11.46

|

|

136

|

Vista Pharma

|

30.32

|

0.87

|

0

|

-0.36

|

-6.03

|

-57.6

|

|

137

|

Zenith Health Care

|

29.88

|

4.1

|

172.67

|

0.03

|

6.64

|

34.98

|

|

138

|

Concord Drugs

|

28.42

|

1

|

25.98

|

1.25

|

13.06

|

9.19

|

|

139

|

Walpar Nutritions

|

28.38

|

2.58

|

67.88

|

0.92

|

5.37

|

29.05

|

|

140

|

Unick Fix-A-Form

|

23.59

|

0.83

|

10.07

|

4.27

|

10.19

|

4.98

|

|

141

|

Omkar Pharmachem

|

21.93

|

2.47

|

125.36

|

0.17

|

2.59

|

87.33

|

|

142

|

Ortin Laboratories

|

19.07

|

1.81

|

0

|

-1.13

|

5.38

|

62.86

|

|

143

|

Link Pharma Chem

|

18.14

|

1.28

|

16.42

|

2.49

|

13.92

|

7.83

|

|

144

|

Ishita Drugs & Inds.

|

17.93

|

2.05

|

21.47

|

2.79

|

11.25

|

12.47

|

|

145

|

Phaarmasia

|

17.37

|

1.48

|

0

|

-2.74

|

3.36

|

-9.83

|

|

146

|

Norris Medicines

|

16.3

|

0

|

0

|

-3.65

|

0

|

-44.9

|

|

147

|

Guj. Terce Lab

|

14.62

|

2.2

|

0

|

-3.52

|

10.77

|

-11.46

|

|

148

|

Kobo Biotech

|

12.98

|

0

|

0

|

-6.34

|

0

|

-25.73

|

|

149

|

Emmessar Biotech&Nut

|

12.74

|

2

|

21.89

|

1.16

|

8.01

|

6.77

|

|

150

|

Parmax Pharma

|

11.86

|

3.02

|

0

|

-1.98

|

22.55

|

8.93

|

|

151

|

Colinz Laboratories

|

11.03

|

1.63

|

30.06

|

1.46

|

4.53

|

7.61

|

|

152

|

Parenteral Drugs

|

9.84

|

0

|

0

|

-25.61

|

0

|

-43.13

|

|

153

|

Hemo Organic

|

8.32

|

2,962.96

|

0

|

-0.18

|

-53.35

|

-134.51

|

|

154

|

Aayush Food

|

6.77

|

1.36

|

0

|

-2.87

|

6.44

|

-41.6

|

|

155

|

iStreet Network

|

6.28

|

0

|

0

|

0

|

0

|

-2,572.23

|

|

156

|

Adline Chem Lab

|

5.8

|

2.27

|

6.45

|

1.54

|

31.35

|

-123.99

|

|

157

|

Beryl Drugs

|

4.69

|

0.63

|

0

|

-1.54

|

3.09

|

20.4

|

|

158

|

Unjha Formulations

|

4.64

|

2.09

|

0

|

-0.45

|

12.35

|

79.45

|

|

159

|

Ganga Pharma.

|

3.94

|

0.73

|

106.48

|

0.09

|

0.38

|

18.78

|

|

160

|

Hind Bio Science

|

3.63

|

4.75

|

0

|

-0.45

|

-52.96

|

-12.07

|

|

161

|

Advik Lab

|

3.33

|

0.92

|

0

|

-0.03

|

-71.73

|

-21.47

|

|

162

|

Bacil Pharma

|

2.6

|

0

|

0

|

-6.48

|

-31.82

|

-0.7

|

|

163

|

Kabra Drugs

|

2.26

|

0

|

0

|

-0.45

|

0

|

-16.78

|

|

164

|

Raymed Labs

|

0.7

|

0

|

0

|

-0.29

|

0

|

-24.05

|

Strengths

- The company has significantly decreased its debt by 2,134.69 Cr.

- Company has a healthy Interest coverage ratio of 97.66.

- The Company has been maintaining effective average operating margins of 20.87% in the last 5 years.

- Company has a healthy liquidity position with a current ratio of 2.35.

- The company has good cash flow management; CFO/PAT stands at 1.06.

Limitations

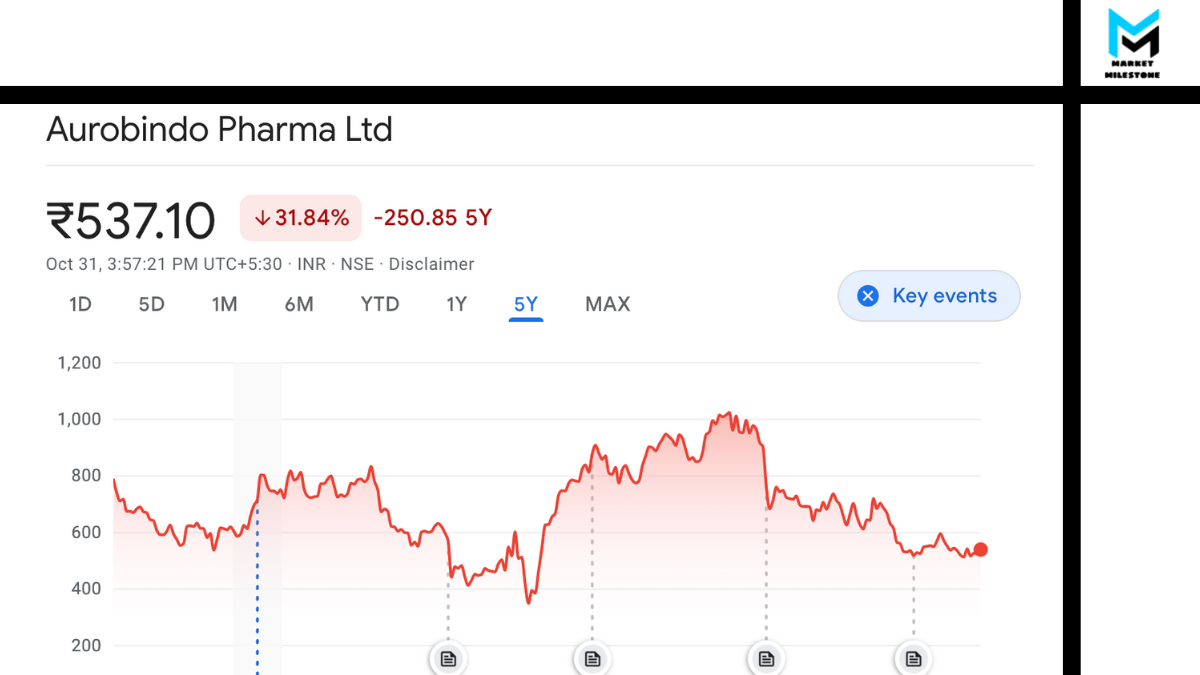

- The company has shown a poor profit growth of -1.66% over the past 3 years.

- The company has shown poor revenue growth of -2.71% for the past 3 years.

- Tax rate is low at 11.16.