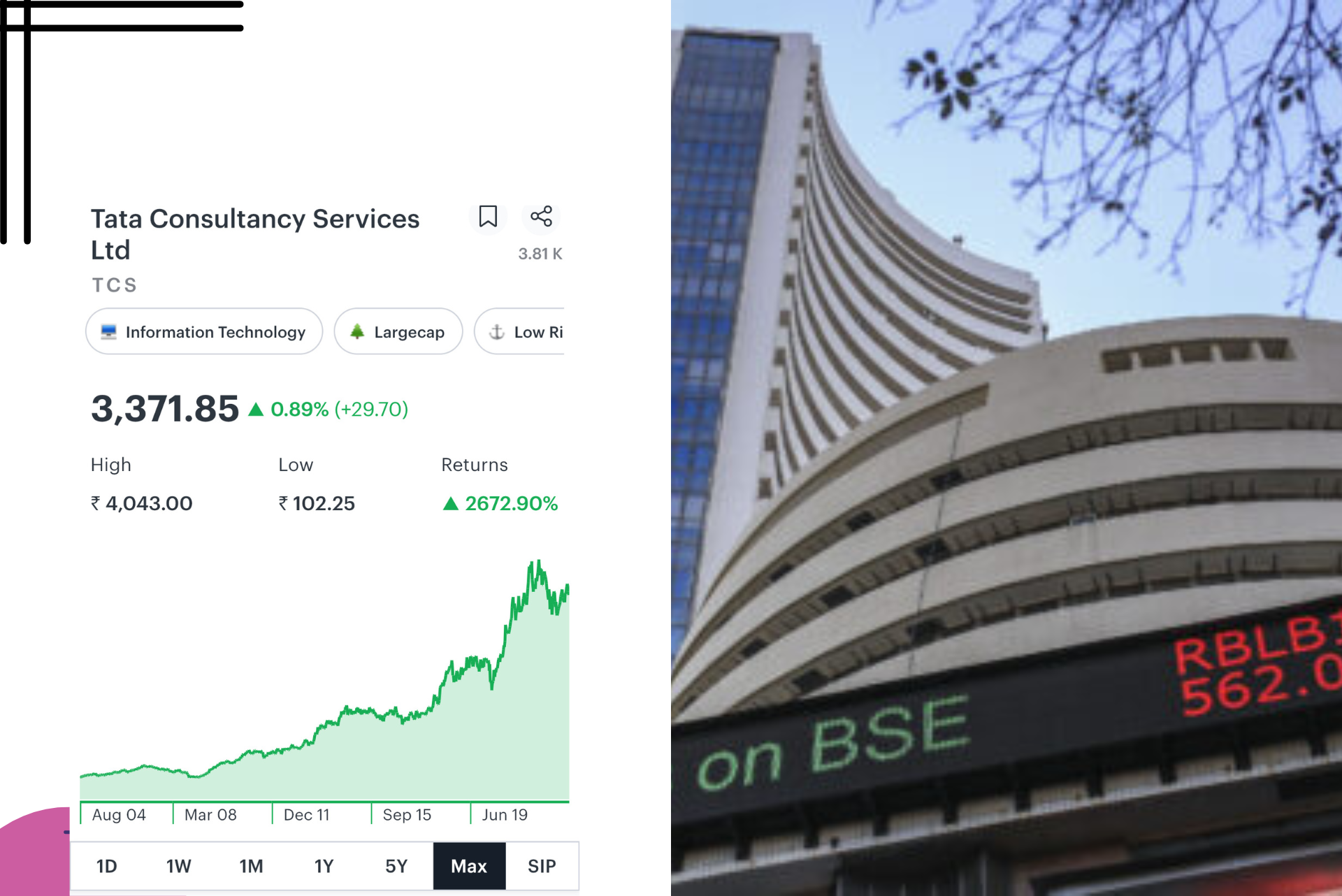

Tata Consultancy Services Ltd Earnings – Financials and Analysis

Analyze Tata Consultancy Services Ltd earnings and financials to understand its financial health and investment potential.

Get an in-depth analysis of Tata Consultancy Services Ltd earnings and financials, including key performance indicators, revenue growth, profit margins, and more. Learn how the company is performing and what the future holds for investors.

Introduction:

Tata Consultancy Services Ltd (TCS) is one of the largest information technology (IT) services companies in the world, with a market capitalization of over $200 billion. TCS provides a wide range of services, including IT consulting, software development, infrastructure management, and business process outsourcing. As a publicly traded company, TCS releases regular financial statements, including quarterly and annual earnings reports, which provide investors with valuable insights into the company’s financial health and performance.

In this article, we’ll take a closer look at the Tata Consultancy Services Ltd earnings and financials, including key performance indicators, revenue growth, profit margins, and more. We’ll also examine how the company is performing in the current economic climate and what the future holds for investors.

Financials and Analysis:

Revenue Growth:

One of the most important metrics for any company is revenue growth, and TCS has been steadily increasing its revenue over the past few years. In its most recent earnings report for Q3 2022, TCS reported revenue of $6.4 billion, representing a year-over-year increase of 22.5%. This growth was driven by strong demand for TCS’s services, particularly in the BFSI (banking, financial services, and insurance) sector.

Profit Margins:

TCS has consistently maintained strong profit margins, which is a testament to its ability to manage costs and maintain pricing power. In Q3 2022, TCS reported an operating margin of 26.5%, which was up 1.4% from the previous year. This strong margin performance was driven by operational efficiencies and cost controls.

Key Performance Indicators:

TCS uses a number of key performance indicators (KPIs) to measure its performance, including revenue growth, operating margin, and employee utilization. In Q3 2022, TCS reported a utilization rate of 88.3%, which was down slightly from the previous year due to the impact of the COVID-19 pandemic on project execution. However, TCS’s utilization rate is still among the highest in the industry, indicating strong demand for its services.

Industry Analysis:

The IT services industry is highly competitive, with numerous players vying for market share. However, TCS has a number of advantages that help it maintain its position as a market leader. These include a strong brand reputation, a global delivery model, and a deep domain expertise in key industries such as BFSI and retail.

TCS has also been investing heavily in emerging technologies such as artificial intelligence, machine learning, and blockchain, which are expected to drive growth in the IT services industry over the next few years.

FAQs:

Q: What is TCS?

A: TCS is a global IT services company that provides consulting, software development, infrastructure management, and business process outsourcing services to clients in a wide range of industries.

Q: How is TCS performing financially?

A: TCS has been performing well financially, with strong revenue growth, high profit margins, and a solid balance sheet.

Q: What are some of TCS's key strengths?

A: TCS's key strengths include its strong brand reputation, global delivery model, deep domain expertise, and investments in emerging technologies.

Conclusion:

Tata Consultancy Services Ltd continues to be a top performer in the IT services industry, with strong financials and a solid balance sheet. Its strong brand reputation, global delivery model, and deep domain expertise give it a competitive advantage in the market,

Add a comment Cancel reply

Categories

- Financial Education (40)

- Intraday Trading (2)

- Market Milestone (48)

- Stock Market India (3)

- Swing Trading (3)

Recent Posts

About us

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Related posts

Concept Challenge

How to Use FNO Calculator By Market Milestone

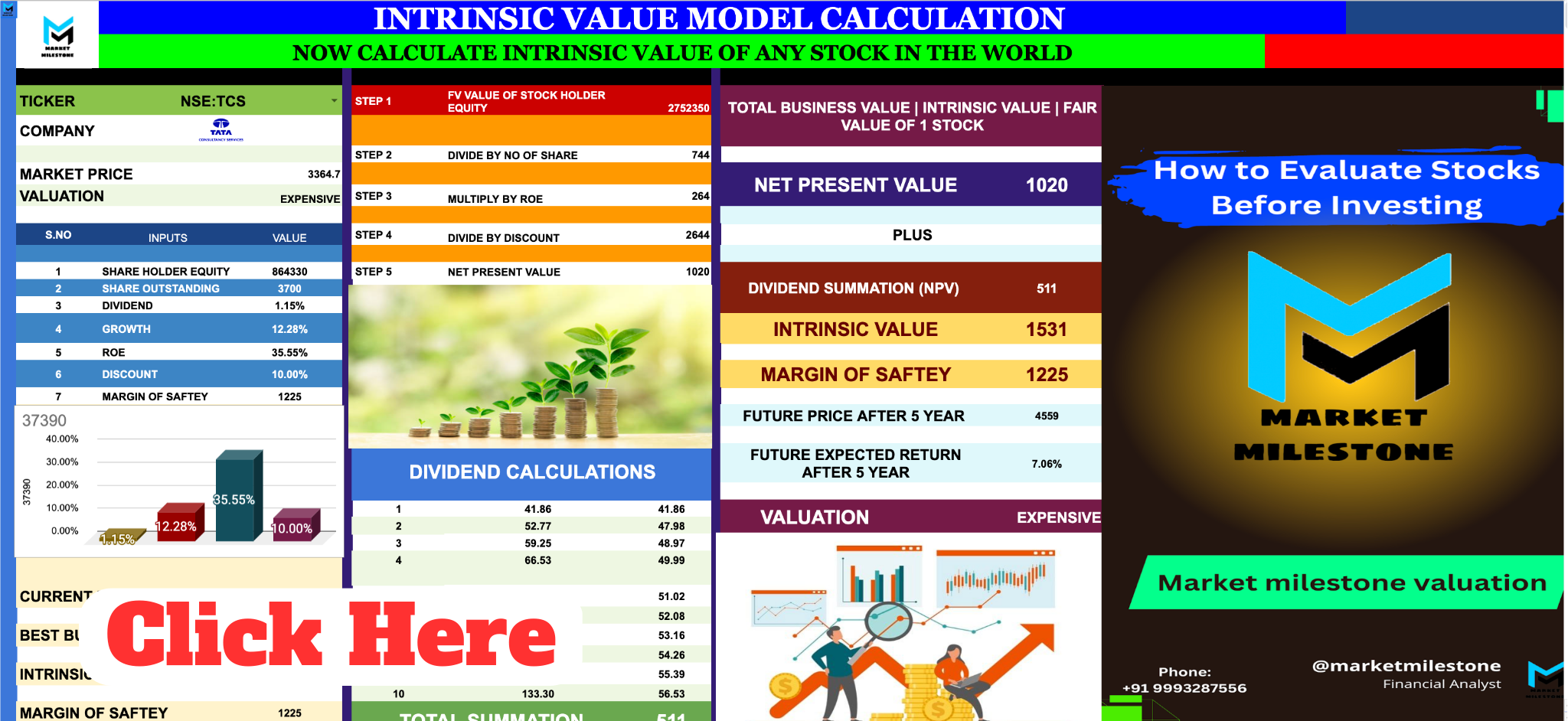

Intrinsic Value CALCULATOR With AI By Market Milestone