Hindustan Unilever Stock: Overview and Performance

Learn about the performance of Hindustan Unilever stock, including its history, current trends, and future outlook. Discover the factors that may affect the stock’s price and why it could be a good investment opportunity for you.

Read this article to know more about the performance of Hindustan Unilever Stock. Get insights into the company’s financial status, market position, and future prospects.

Introduction

Hindustan Unilever Limited, commonly known as HUL, is an Indian consumer goods company with a presence in over 190 countries. The company has a wide range of products, including personal care, home care, foods, and beverages. It is the largest fast-moving consumer goods (FMCG) company in India, with a market capitalization of over $100 billion.

In this article, we will take a closer look at the Hindustan Unilever stock’s performance, including its financials, market position, and future prospects.

Financial Performance

Revenue

Hindustan Unilever’s revenue has been consistently growing over the past few years. In 2020, the company reported a revenue of INR 39,518 crore, which is an increase of 2.4% compared to the previous year. The revenue growth is primarily due to the strong performance of the home care and foods and refreshments segments.

Profitability

HUL’s profitability has been consistently strong, with a net profit margin of around 16% in the past few years. The company’s profitability is primarily driven by its cost optimization initiatives and focus on premiumization.

Dividend Yield

HUL has a dividend yield of around 1.4%, which is lower than the industry average of around 2.2%. However, the company has a consistent track record of paying dividends, which makes it an attractive option for long-term investors.

Valuation

HUL’s valuation is relatively expensive compared to its peers in the FMCG industry. The company has a price-to-earnings ratio (P/E) of around 75, which is higher than the industry average of around 38. However, the premium valuation is justified by the company’s strong financials and market position.

Market Position

Brand Value

HUL is a highly recognized brand in India, with a brand value of over $23 billion. The company’s flagship brands, such as Dove, Surf Excel, and Lipton, have a strong market presence and enjoy a loyal customer base.

Market Share

HUL is the market leader in several product categories in India, such as soaps, detergents, and tea. The company’s market share in these categories is around 30-40%, which is significantly higher than its closest competitors.

Competitive Landscape

HUL faces intense competition from other FMCG companies in India, such as Procter & Gamble, Nestle, and Colgate-Palmolive. However, the company’s strong brand value and market position give it a competitive edge in the industry.

Future Prospects

Growth Opportunities

HUL has several growth opportunities in the Indian market, such as expanding its presence in rural areas and increasing its focus on e-commerce. The company is also investing in research and development to innovate and launch new products to cater to changing consumer needs.

Challenges

HUL faces several challenges, such as rising raw material prices and increasing competition from new players in the market. The company will need to continue its focus on cost optimization and innovation to overcome these challenges.

FAQ on Hindustan Unilever Stock: Overview and Performance

What is Hindustan Unilever's current stock price?

As of [insert date], Hindustan Unilever's stock price was [insert price]. However, it is important to note that stock prices fluctuate frequently and can be affected by various factors such as market trends, news, and company performance.

What is Hindustan Unilever's market capitalization?

Hindustan Unilever's market capitalization as of [insert date] was INR [insert amount]. This reflects the total value of the company's outstanding shares.

How has Hindustan Unilever's stock performed over the years?

Hindustan Unilever's stock has performed well over the years. The company has consistently delivered strong financial results and has shown resilience during periods of economic uncertainty. For example, in the fiscal year 2020-21, the company reported a 20.5% increase in net profit compared to the previous year.

What are the key factors driving Hindustan Unilever's performance?

Hindustan Unilever's performance is driven by several factors, including its strong brand portfolio, widespread distribution network, and focus on innovation and sustainability. The company has a long-standing presence in the Indian market and has built a strong reputation for quality and trustworthiness. Additionally, Hindustan Unilever has invested in developing sustainable business practices, which have helped it reduce costs and improve efficiency.

What are the risks associated with investing in Hindustan Unilever stock?

Like any investment, investing in Hindustan Unilever stock carries risks. Some of the key risks include changes in market conditions, competition, and regulatory changes. Additionally, Hindustan Unilever operates in a rapidly evolving industry, and its success is closely tied to its ability to innovate and adapt to changing consumer preferences.

Conclusion:

Overall, Hindustan Unilever is a leading player in the Indian consumer goods industry with a strong track record of financial performance. While investing in any stock carries risks, Hindustan Unilever’s strong brand portfolio, distribution network, and focus on sustainability make it a promising investment opportunity. By staying informed and conducting thorough research, investors can make an informed decision about whether to invest in Hindustan Unilever stock.

Add a comment Cancel reply

Categories

- Financial Education (40)

- Intraday Trading (2)

- Market Milestone (48)

- Stock Market India (3)

- Swing Trading (3)

Recent Posts

About us

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Related posts

Concept Challenge

How to Use FNO Calculator By Market Milestone

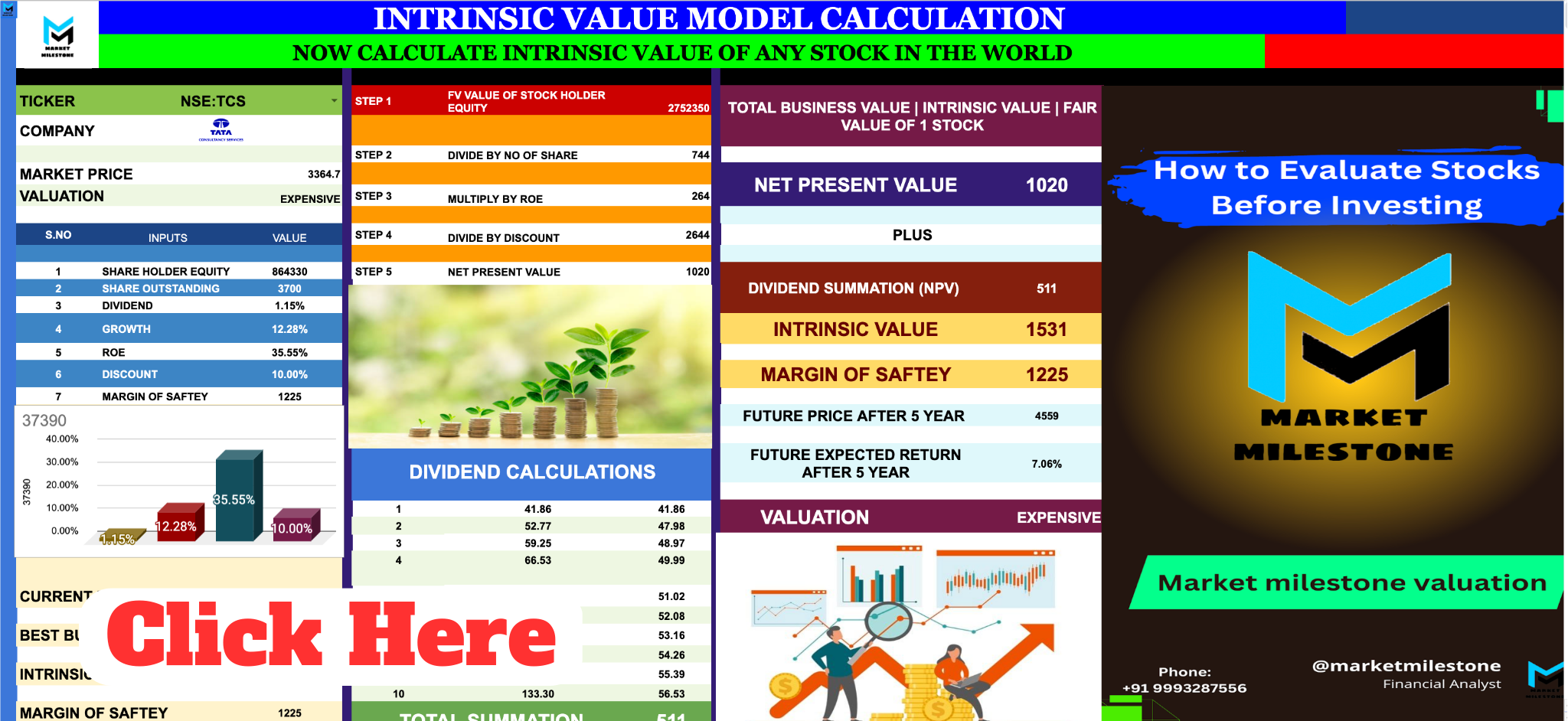

Intrinsic Value CALCULATOR With AI By Market Milestone