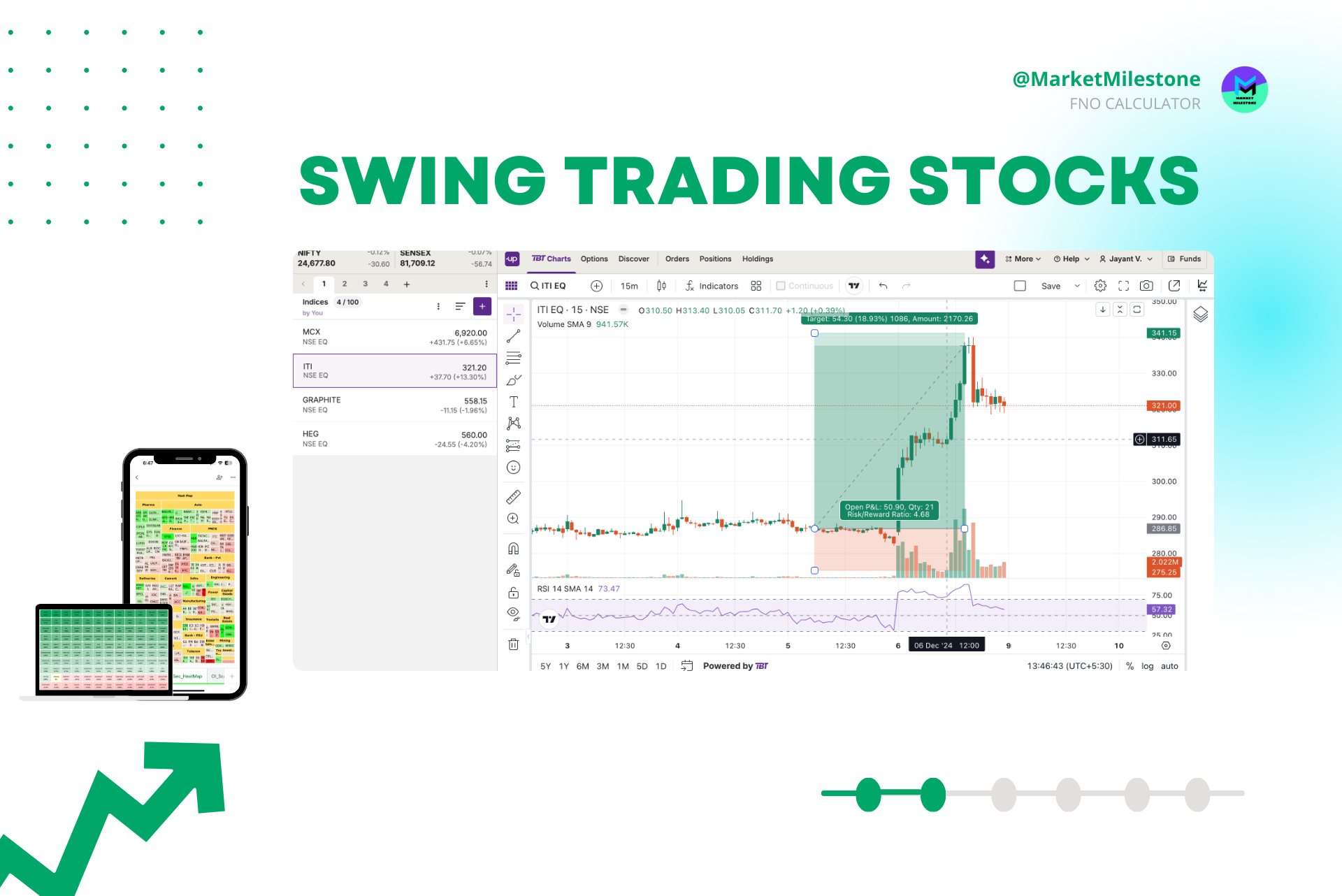

Swing Trading ITI Stock: Achieving +13.03% Profit with FNO Calculator

Swing trading is a dynamic approach to stock trading that focuses on capturing short- to medium-term price movements. Unlike day trading, which involves closing positions within the same trading day, swing trading allows traders to hold positions for several days or even weeks. When combined with tools like the Futures and Options (FNO) Calculator, swing traders can make more informed decisions and achieve significant profits. One such success story is ITI stock, where traders achieved a +13.03% gain using these strategies.

What is Swing Trading?

Swing trading involves identifying stocks with short-term momentum and entering trades based on technical analysis. Traders often use tools like moving averages, trendlines, and candlestick patterns to predict potential price movements. The goal is to capitalize on “swings” in stock prices, which occur when there is a fluctuation between support and resistance levels.

Unlike long-term investing, swing trading does not rely heavily on fundamental analysis. Instead, it emphasizes price action, trading volume, and market sentiment.

ITI Stock: The Case Study

ITI Limited, a leading Indian telecommunications company, recently saw a remarkable price movement of +13.03%. This surge provided a lucrative opportunity for swing traders. Here’s how traders leveraged the situation:

-

Price Pattern Recognition

ITI stock was in a consolidation phase, trading within a defined range. Technical indicators like the Relative Strength Index (RSI) suggested it was not overbought, hinting at a potential breakout. -

Volume Analysis

A spike in trading volume was observed, signaling increased interest and a potential price movement. This is often a precursor to breakouts. -

Entry and Exit Points

Swing traders identified a breakout above a key resistance level and entered positions. They also set stop-loss orders below the support level to minimize risks.

Using the FNO Calculator for Profit Maximization

The FNO Calculator is a powerful tool for traders engaged in futures and options trading. It helps evaluate risk, reward, and breakeven points for a trade. Here’s how it was used in the ITI stock trade:

-

Position Sizing

The FNO Calculator helped traders determine the optimal position size based on their capital and risk tolerance. This ensured they did not over-leverage their accounts. -

Profit Potential

By simulating various scenarios, the calculator showed traders the profit potential of a +13.03% price move. This clarity helped them decide whether to execute the trade. -

Risk Management

The calculator allowed traders to set clear stop-loss and take-profit levels. By quantifying potential losses, it ensured disciplined trading practices.

The Role of Discipline in Swing Trading

While tools like the FNO Calculator are invaluable, disciplined execution is equally important. Traders need to stick to their trading plan, avoid emotional decision-making, and regularly review their strategies.

Key Takeaways for Swing Traders

- Leverage Tools: Use technical analysis tools and calculators to enhance decision-making.

- Plan Ahead: Identify entry and exit points, and stick to them.

- Monitor the Market: Keep an eye on volume spikes and technical breakouts.

- Risk Management: Always set stop-loss orders to limit potential losses.

Conclusion

Swing trading ITI stock demonstrated how traders could achieve substantial profits, like +13.03%, by combining technical analysis with tools like the FNO Calculator. By focusing on disciplined strategies and leveraging technology, swing traders can seize similar opportunities in other stocks.

Add a comment Cancel reply

Categories

- Financial Education (40)

- Intraday Trading (2)

- Market Milestone (48)

- Stock Market India (3)

- Swing Trading (3)

Recent Posts

About us

with its super power, perfect financial appetite, Market Milestone gets you great stocks analysis, action packed calculator and learning on the go.

Related posts

Maximizing Profits with Swing Trading in MCX Stocks Using the FNOCalculator